The Retirement Savings Plan is a 401(k) plan and you can contribute through pre-tax deductions or Roth after-tax deductions.

NOTE: It’s your responsibility to ensure you don’t exceed the IRS annual employee contribution limit. This can happen if you work for more than one employer in a calendar year and contribute to both company’s retirement plans.

*Annual IRS limits apply and include your contribution to another employer’s plan.

Conduit Individual Retirement Account (IRA): A traditional IRA that holds only assets that were distributed from a qualified plan, such as a prior employer’s plan.

You can enroll in the plan and make all of your plan transactions through Fidelity’s NetBenefits website or contact Fidelity directly at 800-835-5091. Representatives are available to assist you from 8:30am to 8pm in your time zone on any business day the New York Stock Exchange (NYSE) is open.

You can instruct Fidelity to move a portion of your pre-tax account balance into a Roth conversion account. If you do so, you will be responsible to pay taxes on the amount that is converted. Reach out to your Fidelity representative directly at 800-835-5091 for more information.

Take advantage of retirement education available through Fidelity.

Live or on-demand workshops. Get help setting short- and long-term goals, controlling debt, saving for college, managing student debt, creating wills and trusts, and much more.

Complimentary consultations. Meet with a Fidelity expert virtually, via phone or in person at your local Fidelity location.

Take advantage of one of the two services to help maintain your investment mix and keep your investments in line with your goals:

Automatic Account Rebalance: Annually rebalances your account to stay consistent with the investment strategy you’ve chosen. Simply identify an initial investment combination, adjust your account to that mix and let the service do the rest.

Rebalance notification: Alerts you by email any time your account’s investment mix strays from your original specification. You can take action immediately to rebalance your account by clicking on a link within the email.

Both you and Hasbro contribute to Social Security, which provides a monthly benefit when you retire to supplement your other sources of retirement income.

Disability benefits, as well as survivor benefits, also may be available to you and your eligible family members.

Sylvia and her husband Tim are expecting their first child and they’re starting to think more about their future. They want to see how the Retirement Savings Plan adds up dollars over time.

What steps should Sylvia and Tim take to make the most of their Retirement Savings Plan?

The Fidelity financial consultant is the best and I truly appreciate the time and expertise.

– Wizards employee

www.netbenefits.com / 800-835-5091

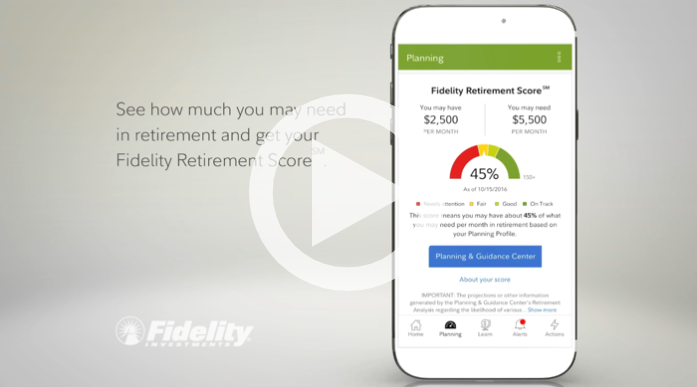

Scan the QR code to download the app today.

Watch this video from Fidelity Investments to see the NetBenefits app in action:

Visit the HasbroBenefitsolver Reference Center to see the Retirement Savings Plan Summary Plan Description for more information.

Pre-tax deductions lower your taxable income in the year of deferral but are taxable at the time of distribution if they are not rolled over to another qualified account.

You pay taxes when your contribution is deducted from your paycheck. Contributions and earnings are not taxed at the time of distribution.